Key Takeaways

- Approaching insurance disputes calmly and professionally improves communication and elevates the chances of a fair resolution.

- Understanding your policy, rights, and obligations empowers you to navigate disputes with clarity and confidence.

- Thorough documentation, strategic communication, and knowing when to seek external help are critical tools for resolving insurance disagreements effectively.

Navigating through an insurance dispute resolution process can feel like a daunting task. These disputes often emerge from claim rejections or misunderstandings regarding policy coverage, and they can be stressful if not handled properly. However, by maintaining a fair and friendly approach, you can elevate the chances of a successful resolution. Whether it’s due to misunderstandings or claim denials, it’s crucial to handle these situations diplomatically to protect your rights and maintain positive relations with your insurer. Creating an amicable environment may even allow for smoother communication, fostering goodwill, and nurturing a constructive dialogue with your insurance provider.

Understanding Insurance Disputes

Insurance disputes often arise from claim denials or disagreements over payouts. These disputes can stem from misunderstandings about policy details or differing interpretations of coverage. An insurance dispute might be triggered by anything from a mismatch in record details to an insurer disagreeing on the value of a claim. Resolving these disputes amicably is essential, not just for personal satisfaction but also for maintaining your standing with the insurance provider. The stakes in these disputes could impact your immediate financial reimbursement, future premiums, and insurability, making it vital to approach them strategically and professionally.

Essential Communication Strategies

Effective communication is key when addressing disputes. Having an open, clear, and structured dialogue with your insurance provider can prevent minor issues from escalating into significant conflicts. Being clear and concise in your conversations with insurers can forestall repetitive issues and pave the way for a smoother process. Always aim to maintain a professional tone; this shows respect and fosters mutual understanding. Whether communicating via email, over the phone, or in writing, it’s crucial to document all interactions meticulously. Remember, documents like emails and claim forms serve a pivotal role in your communication portfolio and can be used as evidence to support your case should the need arise.

Knowing Your Rights and Obligations

As a policyholder, understanding your rights during a dispute is crucial. You are entitled to clear explanations from your insurer and have the right to question or challenge decisions you believe are incorrect. Familiarize yourself with the rights granted under your policy and generally available in your jurisdiction. Equally important is knowing your obligations, which typically include timely premium payments and honest disclosure of necessary information. Thoroughly reading and understanding your policy can provide clarity on these aspects. Having a comprehensive understanding of your policy’s terms and conditions can arm you with the knowledge needed to assert your stance and navigate disputes confidently.

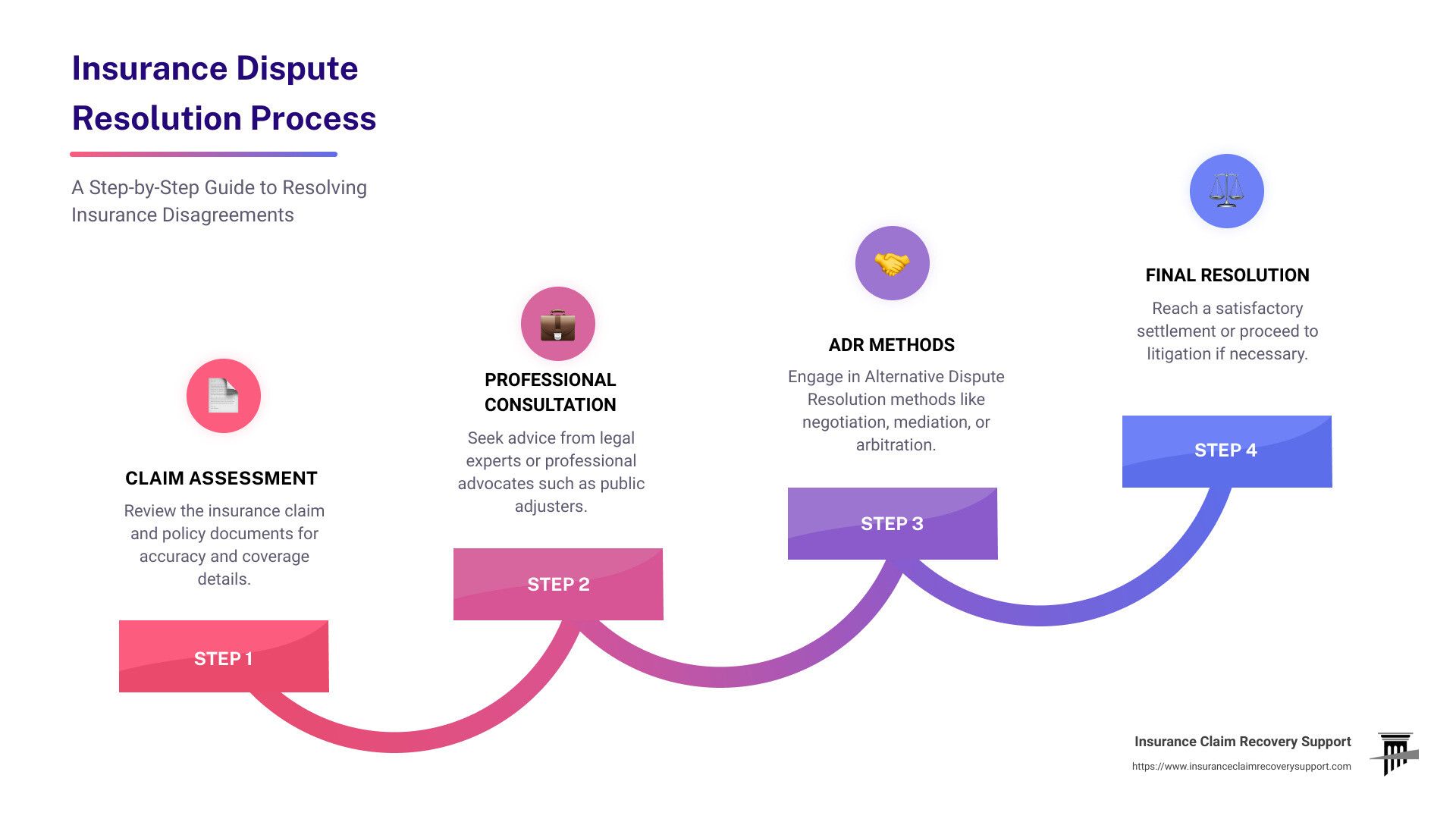

Steps to Take When a Dispute Arises

When a dispute emerges, acting promptly and strategically is vital. Begin by gathering and organizing all relevant information and communications regarding your policy and claim. Ensure that all your records are complete and up-to-date, as any omitted detail can work to your disadvantage. Accurate and detailed records can be your ally in a dispute. Follow a systematic approach — start by contacting your insurer’s customer service to discuss the issue and seek clarification before escalating the matter. Should the initial attempt not yield a favorable outcome, consider escalating the issue to higher authorities within the insurance company. Being methodical and patient in your efforts might lead to a successful and amicable resolution.

Mediation and Arbitration Options

Mediation represents a viable option for resolving disputes without involving formal legal proceedings. It entails a neutral third party helping both sides reach a mutually agreeable solution. Mediation offers a platform to address misunderstandings in a controlled environment that can often lead to creative solutions. Should mediation be unsuccessful, arbitration might be the next step. Unlike mediation, arbitration involves a binding decision made by an arbitrator and can sometimes be a faster resolution path. Each method has its pros and cons, and the choice between mediation and arbitration depends largely on the complexity and nature of the dispute at hand.

Utilizing External Help and Resources

There are times when professional assistance may be necessary. Legal advice can be invaluable, particularly if you are dealing with complex issues. According to Consumer Reports, knowing when to seek external help can make a significant difference in the outcome of a dispute. Legal experts can help you navigate through the murky waters of insurance law and propose strategic ways to handle your case. Additionally, third-party agencies can offer alternative perspectives and suggest additional resolution methods. Utilizing these resources can provide a fresh viewpoint and may illuminate paths toward resolution that you hadn’t previously considered.